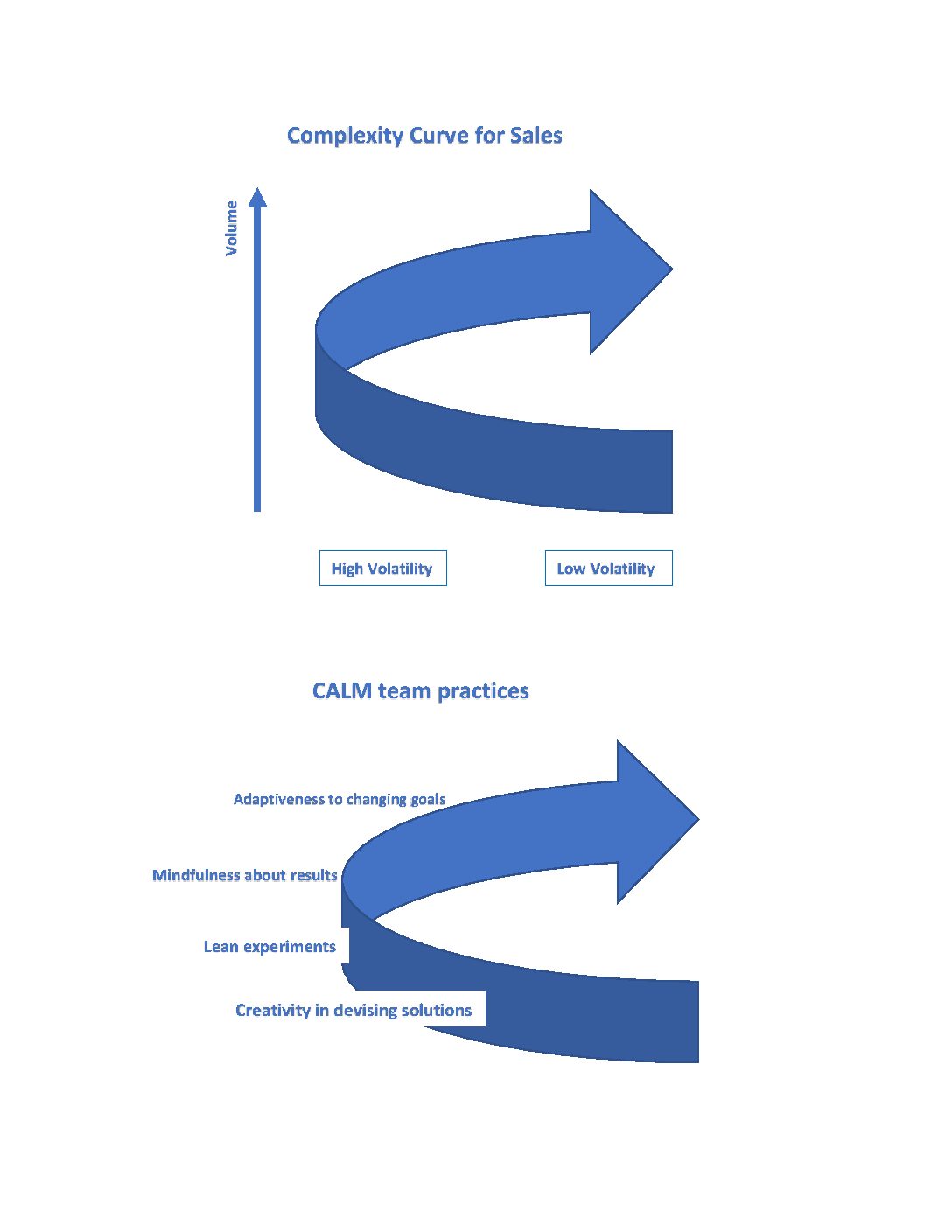

What do you do when big gaps between actual and projected sales or cash flow stare out at you from the books (or your computer screen) week after week? If you’re like most people, your first reaction is to work harder. After all, volatile results make backers nervous and payroll harder to meet. Strangely – and happily – that’s probably a mistake.

A better rule of thumb begins with trying to figure out how much of each performance gap you can explain and how much is unexplained. The unexplained parts of performance gaps are true noise – they would persist even if the parts you can explain were under perfect control. And they’re a common occurrence – “Where there is judgment, there is noise,” write Daniel Kahneman, a behavioral economics pioneer, and some recent Harvard Business Review coauthors, “and more of it than you may think.”

The surprising thing is that unexplained gaps are not necessarily bad news. If the unexplained parts of the performance gaps of your business tend to dominate, you’re probably getting a signal to pivot – not to work even longer hours.

Start with how much of your performance gaps you can explain. If you expected to make ten sales calls and you made only eight, a sales gap should be no surprise. If actual sales are below expected sales, those extra two sales calls are probably part of the reason why.

Unexplained gaps usually mean there’s a hidden success factor that affects your sales or cash flow as strongly as the ones you watch. For example, customer satisfaction or a competitor’s offering may be playing a larger role than you realized. If you can figure out what that success factor is, you may be able to manage it. And if you can manage it, you’ll probably be able to increase your average results at your current level of time, effort, and resources.

In other words, persistent unexplained performance gaps often mean there’s a way to pivot your business.

Wait a minute, you may want to say. What if unexplained gaps reflect the effect of lots of minor hidden success factors that all happen to be less favorable, or all happen to be more favorable, than normal? Identifying any one of them may help at the margin – but won’t make a big difference.

That’s true – but highly unlikely. It’s far more likely that persistent unexplained performance gaps reflect the effect of one big hidden success factor than the effect of lots of minor ones. It would be an amazing coincidence for lots of separate success factors to line up repeatedly on the same side of what’s normal.

This is good news if you feel you’re working too hard. It’s not difficult to see how much of your weekly or monthly performance gaps you can explain. GoalScreen, for example, highlights the unexplained part of performance gaps. However you identify them, unexplained performance gaps provide a rare window into what we don’t know about our business that might make it easier to manage.