PayStand is not the only fintech startup in the Monterey Bay area. But B2B platforms like PayStand are a rarity – collectors’ items for any local economy. PayStand’s recent successful funding round and the attention it’s getting in Silicon Valley (see CEO Jeremy Almond’s Cube interview here) raise the prospect of something seriously exciting for Santa Cruz tech watchers – momentum in the Monterey Bay area toward a platform for intelligent supply chains.

The reason is that in addition to building a platform for fee-based digital transactions, PayStand has sensibly deployed blockchain technology to handle some of the arduous and unloved internal processes at either end of a B2B payment. That could let it tackle procurement as well as payments challenges faced by business networks – something giant providers like SAP Ariba have long hoped to integrate.

PayStand is pioneering the idea of Payment-as-a-Service, offering flat-rate plans to process customer payments digitally rather than taking a cut of bank-intermediated transactions. Renting out a back office for payment processing does more than cut costs – it lets businesses base pricing on the latest changes in supply and demand or on how soon a customer is willing to pay (so-called “dynamic discounting”).

The technology lets PayStand push the envelope in tokenization – a variation on encryption that verifies customers without exposing account data – and use blockchain-enabled distributed ledgers to notarize invoices and certify payments. By fundamentally altering the source of trust in financial transactions, as Jeremy says, blockchains are creating a new set of winners and losers.

Blockchain raises the interesting possibility that, in addition to acting as an anticoagulant for the payments customers make, PayStand can also illuminate the things supply chains provide. (PayStand is also starting to process firms’ own payments.) That means managing the cash flow and procurement risks at either end of every B2B transaction – risks that grow as sales increase.

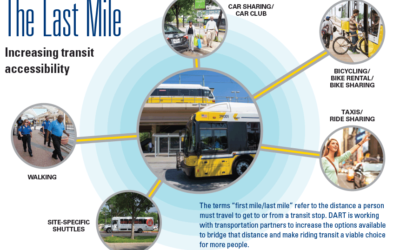

But by reducing the friction in increasingly complex business networks, PayStand can enable whole supply chains to compete with much of the efficiency of big, vertically integrated companies. Imagine, for example, firms linked in a smart agricultural supply chain able to lighten dynamically the working-capital burden of suppliers who are innovating to meet new regulatory requirements.

Networks of smaller firms might be more sustainable and better able to challenge the biggest. Leave it to Santa Cruz to explore opportunities for improving the sustainability of the startup ecosystems under construction over the hill.